Teva to harmonize European operations

When Teva acquired ratiopharm in 2009, it picked up more than just a competing pharmaceutical manufacturer and distributor. Teva also decided that the core principles ratiopharm’s supply chain model should be adopted throughout Teva’s European operations.

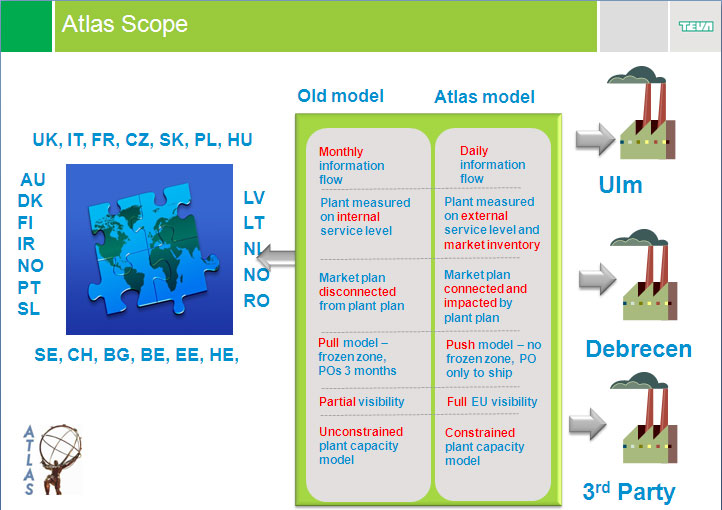

The resulting project, called Atlas, went live in Ulm (the former ratiopharm’s headquarters) and at Teva’s manufacturing plant in Debrecen, Hungary in September 2011. Germany and Spain were the first countries to be connected to the new model; Atlas aims to add an additional country every few weeks, with a target to integrate all of Teva Europe by the middle of 2012.

Roy Amozeg was one of two solution architects assigned to the project and had ultimate responsibility for managing the Supply Chain Application Group within Teva IT. He tells us how the project came into being.

“There was a goal in Teva to improve our supply chain model in Europe and to provide a comprehensive IT solution for the European supply chain organization,” he explains. “When we evaluated the requirements, we realized that, with a few tweaks, we could adopt the ratiopharm approach.”

That doesn’t mean the change would be a simple “copy and paste,” Amozeg continues. “The entire supply chain in ratiopharm was centralized in one place with a single ERP system to manage all the countries ratiopharm was active in. Also, ratiopharm had one plant only located in Ulm. Teva, on the other hand, has many plants serving Europe and it gives each country autonomy in planning. Individual markets run their own Finished Goods planning process, and they are using many different platforms and systems. The result is that Teva is much less harmonized than at ratiopharm, while the supply chain network is much bigger”

There were other significant differences between ratiopharm and Teva, which factored into the Atlas project. For example, Teva plants operate at a high utilization rate, with constant production bottlenecks, while ratiopharm operated at a lower utilization rate. This presented new requirements and further complexity to the model

An even bigger challenge was that, in ratiopharm unlike in Teva, responsibility for Finished Goods inventory as well as for service level to end customers was managed by the same entity: the central supply chain. In Teva, however, the plants have traditionally had responsibility only for supplying product according to market demand, with no visibility into market service or inventory levels, let alone responsibility for these important factors. “This has meant a huge conceptual change and a shift in the roles and responsibilities of supply chain members and stakeholders,” Amozeg explains.

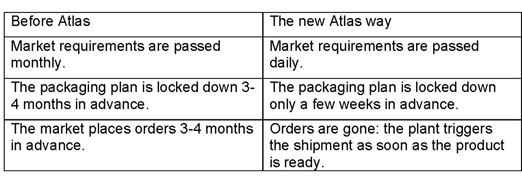

In the new Atlas model, a more flexible approach is required. Demand information from the markets has to be as up-to-date and relevant as possible, in order to allow the plants to react quickly to changing requirements. Planners need to know in real-time their market stock situation and inventory projection. This can be seen more clearly in the following chart:

But supply chain requirements necessarily contradict with cost objectives. Markets request different amounts of product at different times, depending on real-time changing needs; that’s not always the most cost effective way to run a manufacturing plant. Atlas helps align all the supply chain parties – both the markets and the plants – towards the same two primary objectives: excellent service levels and controllable inventory levels. Cost is still looked at, but no longer in isolation, and always alongside the customer-facing targets

While the new Teva model adopts the ratiopharm approach, Teva’s IT still had a key decision to make: whether to use Oracle or SAP for its ERP infrastructure.

“This took a lot of negotiating,” Amozeg explains. TGS, the project initiator, wanted the new model in place within five months. “So at first we looked towards a short-term solution, using just SAP, which is what ratiopharm had in place. But we knew that SAP couldn’t support all of the features which were required. Also it was clear that using Oracle made more sense as the long term solution due to its wide presence in Teva and its flexible and scalable capabilities.”

Eventually, the long-term approach was chosen and, for that, Oracle’s APS (Advanced Planning and Scheduling) suite won the day.

From a project management point of view, Atlas presented additional challenges. “Because management wanted a quick start, we didn’t have the time to do what we usually do, which is to close down the scope before we start and commit to a budget and timeline,” Amozeg says. While the scope eventually was locked in, the initial fluidity led to a three-month launch delay, from July to September 2011.

The roll out is now going according to schedule. In addition to connecting Germany and Spain to the new model in September, by the end of 2011, Finland, Norway, Sweden, Portugal, France, Bulgaria, Slovakia and Poland were also online. Atlas will eventually cover 27 markets, with 30,000 Finished Goods SKUs planned.

The Atlas project covers only Europe. A parallel initiative, called Polaris, is taking the same approach for Teva’s supply chain operations in the Americas.

The project could not have been completed without the help of a whole host of IT personnel at Teva in Israel, Ulm and Debrecen. Inspirage, a third party integrator based in India; a representative from Oracle; as well as Cees Hoek, the project manager from the EU SC organization, all participated. Amozeg singles out a few of his superstars:

• Arup Chatterjee – Solution Architect (Inspirage)

• Eyal Wiseman – Integration track lead (Teva)

• Astrid Faber – Integration track lead SAP (Teva)

• Etan Spierer – 3rd party planning track lead (Teva)

• Josef Roder – 3rd party planning track lead SAP (Teva)

• Klaus Eberle – EU IT (Teva)

• Piotr Suchy – Exceptions Management track lead (Oracle)

• Diwaker Gunturi – Teva Finished Goods track lead (Inspirage)

• Vilmos Kui – Local IT in Debrecen (Teva)

• Rajesh Kutty - Demand Management track lead (Inspirage)

• Ayala Grosser – BI track lead (Teva)

Amozeg says that he and his team have learned a number of important lessons from the process so far. First and foremost, there is nothing like having close interaction with users. “This meant a lot of traveling, up to two weeks a month,” he says. “But it can really speed up communication and cut through problems. You don’t have to wait for an email; you can just grab someone from the other room.”

Another important lesson: “Even though everyone is pushing and wants it fast, we need to take the time to go through the detailed scoping exercise and not start building until that’s ready,” Amozeg says. “We missed on this one. We didn’t push back hard enough.”

Nevertheless, Amozeg says he is “very proud to have made this happen. It was a huge technical challenge with very demanding requirements.”

Would Amozeg consider the Atlas project a success? From the IT side, it’s a resounding yes. “We delivered almost all the business requirements. And it’s working,” he says, then adds, “time will tell if Teva will get the business benefit it is expecting. The ultimate goal is to improve service levels. Ask me again in nine months to a year from now.”

We certainly will.

Design and production: Stern Visual Communications, http://www.stern.org.il

Content development: Blum Interactive Media, http://www.bluminteractivemedia.com