Joint venture with Proctor and Gamble goes live with new Cash to Order processes

The usual way that goods are distributed among Teva’s sites is relatively straightforward. The market orders a product, the manufacturing plant produces and delivers it, and the market pays the plant.

But when Teva entered into a joint marketing venture with leading consumer goods company Proctor and Gamble last year, a necessary but nevertheless circuitous layer of complexity was introduced. Orders, invoices and payments now needed to be passed through a new company under the shared ownership of Teva and Proctor and Gamble – an electronic “middleman” of sorts.

To build that new processing flow, Global IT tasked Nitzan Eini, Logistics Sales and Distribution Applications Manager working in the IT Shared Services Center (SSC), with managing the project, called internally “Miami.” Eini’s Day One mandate was to launch the key “Order to Cash” module by November 1, 2011.

It’s been two months since November, now. So, how did it go? “It was a success,” says Dorit Shami, the Global Business Owner for the project. “The key indicators were minimum business interruptions, building the JV entity on Teva’s ERP systems as a ‘pure financial entity,’ and accurately handling all the accounting and tax requirements for both of the JV partners.” Shami adds that “we generated some modifications to the vanilla I/C process, but most of them were handled globally and the current day to day order-to-cash processes were implemented smoothly with only minor impact on the plants and distributors.”

In other words, no one should have noticed that data for the joint venture was flowing through an entirely new legal entity. And they didn’t: for both Teva and Proctor and Gamble, it was just another day at the office.

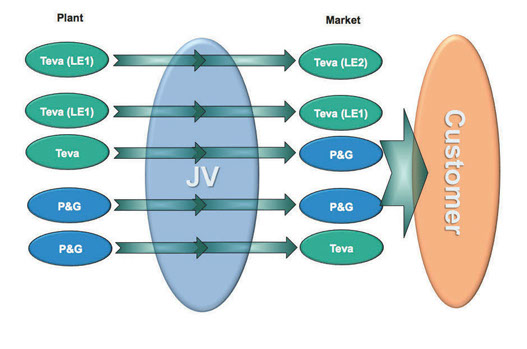

Getting there, though, took a lot of behind the scenes coordination. The best way to get one’s head around the changes can be seen in the diagram below.

The Day One launch focused on the first scenario – going from one Teva Legal Entity (LE) to a second one via the new joint venture layer. In practical terms, that means that new invoices are issued to the appropriate parties and, as Eini explains, “the margin between the JV buying price and the JV selling price becomes the profit.” For the joint venture, what once was one transaction is now two: from the plant to the JV and from the JV to the market.

In the diagram, LE1 and LE2 don’t represent single plants or markets. “It includes Poland, Hungary, Russia, Germany – all of Europe, not just a specific country,” Eini points. “We have a huge matrix where every combination is possible.” Indeed, some 10 plants and 40 markets are represented in that matrix.

The Teva-Proctor and Gamble joint venture was created to expand Teva’s presence in selling over the counter (OTC) products through new channels. The joint company created, to be called "PGT Healthcare," will be based in Switzerland with a new board and management, and will be owned 51% by Proctor and Gamble and 49% by Teva. The joint venture covers Proctor and Gamble products in all countries worldwide except North America.

There were a number of challenges Eini needed to manage from the get-go. First and foremost: a very tight deadline: the project kicked off in May 2011 and went live only six months later – and there was zero tolerance for postponement. “It was simply not an option for IT,” Eini says. “Plus we had another partner involved, so we had to be accurate. People worked very hard; it was quite intense.”

Another challenge was “our huge backlog of orders all across Teva,” Eini says. “This was all configured to work without the JV.” To support the launch, a SWAT team was established in case of emergencies. Did they have anything to do on Day One? “There were some minor issues, but these related more to business licensing not IT,” Eini says. “Overall it went quite efficiently.”

Like Shami, Eini measures success in two ways. First, that there was no business interruption; no delays in shipments. And, second, that all transactions are being captured by the JV. “We can’t have any leakages or bypasses,” Eini says. “The JV must reconcile and close its financial books on time.”

The first end period reconciliation took place at the beginning of December, 2011 and, says Shami, we successfully “generated and forwarded all the reports and data that Proctor and Gamble required to enable the consolidation process.” She adds that, “the JV finance trustees who were nominated per ERP system and the support from the IT SSC were essential,” as was the cooperative effort by Teva and Proctor and Gamble’s tax experts who had to deal with the complexities of tax, transfer price and customs issues.

Next up: correlating all of the figures generated so far with the analyses made by Proctor and Gamble as part of the looming year-end process.

Three teams were involved from Global IT – Israel, Ulm (led by Nadin Kraus) and Zagreb (led by Elena Ostric) – and three ERP systems had to be integrated (Ulm and Zagreb are on SAP; Israel uses Oracle). There was coordination with the parallel Proctor and Gamble teams, and local IT teams took part, especially in Hungary, the Czech Republic, Poland and Russia. Shami was delighted with the relationship.

“Our counterparts at Proctor and Gamble were a joy to work with,” she says. “And I learned a lot from our IT department: they have a very defined process, from CRP to user acceptance testing and training. The project went so smoothly because of the people who were leading it.”

Eini agrees that collaboration was key, between the teams and also “the alignment of business and IT. It’s a great example of how the two working together for the same goal can make complex things happen.”

Eini says credit goes out to a large team of IT staff, including Itzik Bick, Sima Kantor, Uzi Dror and Avi Mergi, as well as Kraus and Ostritch. Eini gives a special thanks to Jack Olster, who led the Global SSC group and the entire Miami project until he moved to another position within Teva. In addition, Eini says that the help from the Master Data Teams – Yacov Elgad, Tamar Saliternik and Danielle Elli – was essential.

Shami extends two additional critical shout out’s – to Kobi Altman, the Finance leader of the project, who she acknowledges “for his support in pointing out any areas where the process could be simplified“ and Ravid Barzilay from the Global Tax Counsel who Shami says “supported this project with creative solutions and hard work.”

P and G Miami IT team Global ERP Oracle (left to right)- Itzik Bick, Nitzan Eini, Sima Kantor, Uzi Dror, Avi Mergi

Previous

Next

Design and production: Stern Visual Communications, http://www.stern.org.il

Content development: Blum Interactive Media, http://www.bluminteractivemedia.com